Whether you are saving money in an IRA (individual retirement account), a 401(k) plan, or some similar plan where you are responsible for managing your money, there are certain prudent measures you can take to ensure that your investments do not fluctuate wildly when the stock market suddenly changes direction. Here are some “rules of thumb” to take into consideration when deciding how to manage your money. I need to remind you, though, there are no guarantees with any investment management strategy. No matter what you do with your retirement savings there will always be some risk involved and some chance that you’ll make an unfortunate choice at a pivotal time.

Whether you are saving money in an IRA (individual retirement account), a 401(k) plan, or some similar plan where you are responsible for managing your money, there are certain prudent measures you can take to ensure that your investments do not fluctuate wildly when the stock market suddenly changes direction. Here are some “rules of thumb” to take into consideration when deciding how to manage your money. I need to remind you, though, there are no guarantees with any investment management strategy. No matter what you do with your retirement savings there will always be some risk involved and some chance that you’ll make an unfortunate choice at a pivotal time.

Rule No. 1: Only Invest in the Liquid Asset/Money Market Fund

If you are still making contributions to your retirement fund from your paycheck you should NOT allow a computer process to make your investment decisions for you. Instead, have the money deposited in the “cash” account that most if not all retirement plans use. This is usually a money-market fund that pays relatively small interest on the balance.

Although you don’t want to leave all of your money in this account for very long, it is better to know that you can “spend” this money without losing anything on your next transaction. That is important because as you trade in and out of the mutual funds that are available you may actually lose money, especially if you trade at the wrong time.

Many mutual funds, for example, earn interest and/or dividends. So even while their trading prices may decline with the rest of the market it may make sense to leave your money in the shares (perhaps even to buy a few more) simply because the mutual fund will earn interest and/or dividends every month or every quarter.

You should always keep some of your retirement plan in a “liquid” account so that you can make purchases when you know the time is right.

Rule No. 2: Never Borrow Against the Value of Your Mutual Funds

If you have to take a loan out against your retirement savings, it is better to only borrow an amount that your liquid asset/money market account balance can cover. This way you won’t be forced to sell any shares in mutual funds before you are ready to do so.

Of course, if you have to borrow more than you have available in that cash account then you want to be the decision-maker about which mutual shares to sell off, not a computer program. So make sure you have enough cash in your account to cover any loans you take out.

Rule No. 3: Consider Using the 3/3 Rule When Selling

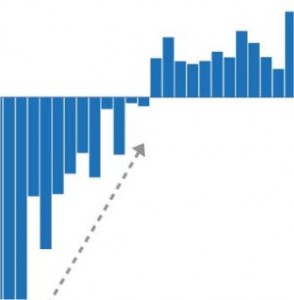

The 3/e rule works like this. Say the stock market is declining and you’re not sure you want to keep your money in a certain mutual fund. Of course, everyone knows that the stock market (and the mutual fund) will eventually rebound; the question for you is really about whether you can protect your value elsewhere as the market declines.

If you are invested in a mutual fund that pays a dividend and/or interest, then the 3/3 rule says you should only sell after being invested in that fund (at the current level) for at least 3 months (1 quarter) AND only if the fund declines in share price 3 days in a row. You want to sell on the 4th trading day regardless of what happens then.

The 3/3 rule attempts to protect you from selling too soon (before you have earned any interest or dividends) AND from waiting too long to sell (by allowing hope to hold you back — hope that the share price will suddenly turn around).

Think of the 3/3 rule as a compromise between common sense and anxiety. It ensures you derive SOME value from a short-term investment.

But, really, if you don’t think you’ll need to dip into your retirement savings within the next 2 years it is better to leave your investments alone regardless of what the stock market looks like today.

Rule No. 4: Invest for 48 Months

Two years is a really long time when you’re talking about the stock market. But what works best with stock investments is TIME. Given enough time most mutual funds will increase in share price value; more importantly, your balance in a given fund should increase as it reinvests dividends and interest earned.

When your contributions go directly to your mutual fund choices you’re less likely to leave your money alone. When you have your contributions deposited directly to your cash account you are better able to think through purchase and sale decisions.

So any time you buy shares in a mutual fund your intention should be to leave those shares alone for at least two years. This may not prove to be the reality, but if you rely on other assets first you will protect your investments while they age and grow.